Irs computer depreciation

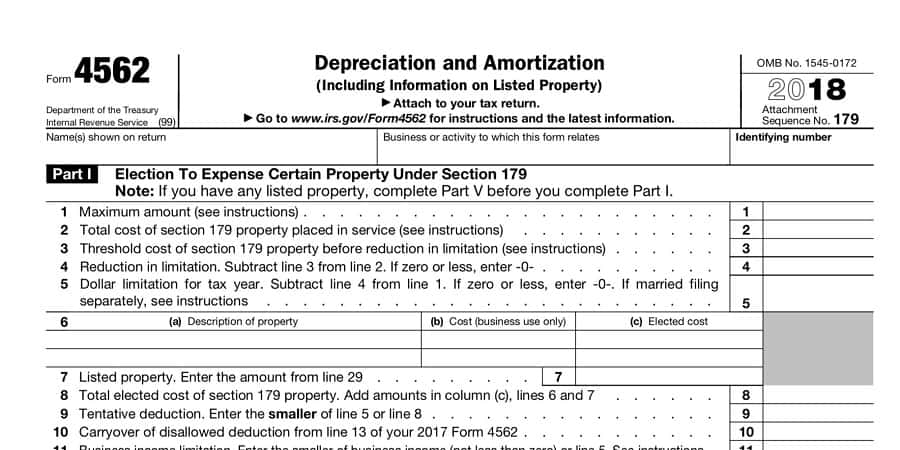

Claim your deduction for depreciation and amortization. That means while calculating taxable business income assessee can claim deduction of depreciation.

Section 179 For Small Businesses 2021 Shared Economy Tax

The IRS came to the following conclusions on the tax treatment of the computer costs.

:max_bytes(150000):strip_icc()/4562-0ccce5dc10454fcea87824d93ca6da97.jpg)

. Therefore you must depreciate the software under the same method and over the same period of years that you depreciate the hardware. About Form 4562 Depreciation and Amortization Including Information on Listed Property Use Form 4562 to. The IRS regulations require that buildings be divided up into as many as.

These methods mean you essentially dont have to bother with calculating depreciation at all as long as your computer purchase meets certain conditions. Additionally if you buy the software as. Depreciation is an annual income tax deduction that al-.

Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. According to IRS publication 945 chapter 4 httpswwwirsgovpublicationsp946ch04html Computers and peripheral equipment are. 1 the cost of the purchased software including sales tax should be capitalized under.

If a taxpayer claims 100 percent bonus depreciation the greatest allowable depreciation deduction is. 18000 for the first year 16000 for the second year 9600 for the third year. In the case of computer software which would be tax-exempt use property as defined in subsection h of section 168 if such section applied to computer software.

Depreciation lets business owners deduct a percentage of the original cost of an item over its lifetime rewarding investment and covering some of costs of maintaining older. IR-2020-216 September 21 2020 The Treasury Department and the Internal Revenue Service today released the last set of final regulations implementing the 100. Depreciation of Computers Computers and laptops used for work or partly for work may generally claimed as a tax deduction with the claim adjusted to include the percentage of.

The rate of depreciation on computers and computer software is 40. Irs computer depreciation Saturday September 10 2022 21500 0 20 years 1075 annual depreciation. Any manager department head network administrator or other IT professional charged with acquiring configuring deploying maintaining and eventually replacing hardware.

NW IR-6526 Washington DC 20224.

Depreciation Nonprofit Accounting Basics

Depreciation Nonprofit Accounting Basics

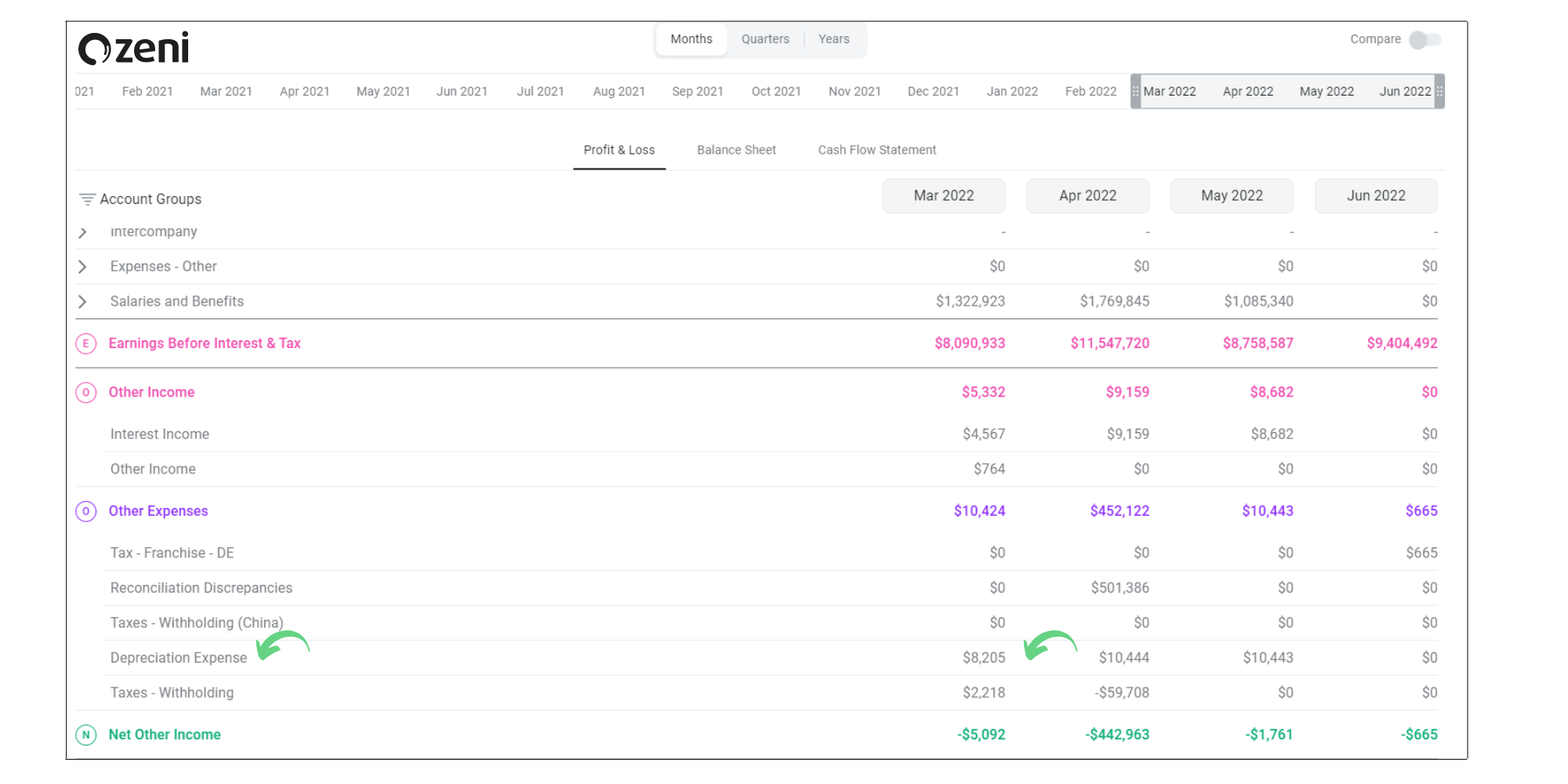

What Is Depreciation And What Does It Mean For Startups Zeni

What You Should Know About The New Irs Depreciation Rules

/double-declining-balance-depreciation-method-4197537-FINAL-9baf4fb736b74a1686dd768332f364b3.png)

Double Declining Balance Ddb Depreciation Method Definition With Formula

Depreciation Of Computer Equipment Computer Equipment Best Computer Computer

:max_bytes(150000):strip_icc()/4562-0ccce5dc10454fcea87824d93ca6da97.jpg)

Form 4562 Depreciation And Amortization Definition

4 Tax Tips For Small Business Owners Tips Taxes Business Small Business Tax Small Business

Depreciation Of Business Assets Definition Calculation How It Affects Your Taxes Pocketsense

Section 179 Bonus Depreciation Saving W Business Tax Deductions Envision Capital Group

The Basics Of Computer Software Depreciation Common Questions Answered

What Is Straight Line Depreciation Yu Online

Amortization Vs Depreciation What S The Difference Independent Business Owner Financial Advisors Tax Accountant

What Is Depreciation The Ultimate Guide With Examples Blog Inbound Hype

Understanding Tax Depreciation In 2022

Understanding The Depreciation Deduction How To Use It To Reduce Tax

:max_bytes(150000):strip_icc()/desk-writing-work-pen-office-business-676191-pxhere.com-ff806b26e1734bde82038a304564daf8.jpg)

What Is The Tax Impact Of Calculating Depreciation